Governance Body Composition

Discover how governance body composition reporting promotes transparency and diversity in corporate leadership. Learn about the disclosure requirements, SEC guidance, NASDAQ regulations, and best practices for reporting on board composition, skills, qualifications, and diversity. Stay informed on the evolving landscape of corporate governance and its impact on organizations' social responsibility.

Background

In a dynamic market where investors place a high priority on a company’s commitment to fulfilling its social responsibility, stakeholders are keen to learn about the leadership and background of the individuals leading the company. Governance Body Composition reporting provides transparency regarding the diversity, equity, and inclusion (DEI) of the board and other executives involved in the company’s management. This entails disclosing information about the background and experience of board members, including details about their ethnicity, gender, generation, as well as salary and compensation information for executives. The number of companies disclosing these metrics is growing rapidly, with Fortune’s recent study revealing that over 90% of S&P 500 boards now disclose racial representation in their financial statements. Many believe that by establishing a diverse and inclusive board, a company can set the tone at the top, showcase its values, and encourage similar practices throughout the entire organization.

While other disclosures may encompass information about DEI efforts for employees at all levels of the company and the actions taken by those responsible for governance to ensure effective company operations, this article specifically focuses on the composition of the board and other executives, as well as their backgrounds. For further details on these other topics, please refer to the sections on Diversity, Equity, and Inclusion Reporting or Management, Board, and Committee Oversight.

Reports That Include These Disclosures

A company communicates information regarding Governance Body Composition through a variety of reports, some required, and others voluntary:

Footnotes to the Financial Statements

The SEC requires that certain disclosures be included in the footnotes of the financial statements, which will be further discussed below. Companies may elect to voluntarily provide more ESG disclosures in other formats, such as a sustainability report or a proxy statement.

Sustainability Report

These are voluntary reports including measures of nonfinancial performance, often with an emphasis on matters associated with ESG reporting. While not required, many industry leaders publish these reports to showcase their commitment to social responsibility.

Proxy Statement

Often referred to as an S-K report, a proxy statement is a unique report involving disclosures on Governance Body Composition. This document is required to be sent to shareholders before an annual meeting where the company will be voting on important matters. This helps shareholders make more informed decisions by including information such as proposed members to be added to the board and current salaries for company executives.

SEC Existing And Proposed Guidance

For public companies complying with SEC requirements, it is crucial to acknowledge the mandatory disclosures currently in place for corporate board composition. The following paragraphs will discuss the current and proposed SEC guidance regarding corporate board composition, the rationale behind the regulations, and their implications for public companies.

2009 Proxy Disclosure Enhancements

The first enhancement of disclosure requirements concerning board governance and composition was approved on December 16, 2009. The objective of this rule is to enhance the information provided to shareholders, enabling them to make more informed assessments of the leadership of public companies.

Relevant Implications of the 2009 Final Rule

The rule mandates disclosures in proxy and information statements regarding:

- Company policies for considering diversity in board candidates

- The implementation of the declared policy

- The measurement of policy effectiveness, at least on an annual basis

This rule does not impose specific requirements for the number of diverse board members, nor does it necessitate disclosure of board demographics. Its purpose is to establish a foundation for companies to develop policies that consider diversity in their governing boards.

2019 Compliance and Disclosure Interpretations

Due to existing ambiguity and variation in disclosure practices among public companies following the 2009 rule, the SEC issued two clarifying statements pertaining to corporate board governance. These statements are documented in Question 116.11 and Question 133.13 of the Regulation S-K Compliance and Disclosure Interpretations, released on February 6, 2019.

Relevant Implications of the 2019 Interpretations

If a board takes into account an individual nominee’s self-identified diversity characteristics (e.g., race, gender, ethnicity, religion, nationality, disability, sexual orientation, or cultural background) during the nomination process, the SEC now expects disclosures that include:

- The self-identified diversity characteristics considered for each candidate

- How the self-identified diversity characteristics were taken into account

These disclosures are made in the item 401 report of a company’s S-K if they are not already disclosed in the footnotes of the company’s 10-K report.

SEC Proposed Rule for The Enhancement and Standardization of Climate-Related Disclosures for Investors

The SEC is proposing amendments to its rules under the Securities Act of 1933 and Securities Exchange Act of 1934, inviting public comment, to require registrants to provide specific climate-related information in their registration statements and annual reports. The proposed rules would necessitate disclosure of a registrant’s climate-related risks that could reasonably have a material impact on its business, financial condition, or results of operations.View the proposed rule here.

Implications of Proposed Rule

If approved, the proposed rule would require companies to disclose the number of board or management members with prior climate expertise in relation to board composition.

The introduction of this rule may prompt registrants to place more importance on climate expertise when seeking directors, potentially leading to deviations from the board composition that would have been in place without the proposed rule.

Other Pending SEC Guidance

In addition to the aforementioned proposed rule, there is a pending SEC rule titled ‘Corporate Board Diversity’. This rule has been pending since spring 2021, and no further information has been provided regarding the provisions of the proposed rule.

NASDAQ Exchange Requirements

In addition to SEC guidance, the NASDAQ stock exchange has its own requirements regarding board composition. In August 2021, the SEC approved the NASDAQ Board Diversity Rule, reflecting the exchange’s commitment to prioritizing diversity. The Rule stipulates the following requirements for board membership:

- By August 7, 2023, each company must have at least one diverse director (or provide an explanation if it does not meet this requirement).

- By August 6, 2026, each company must have at least two diverse directors (or provide an explanation if it does not meet this requirement).

Out of the two diverse directors, one must be a woman, and the other must be a member of an underrepresented minority or the LGBTQ+ community. This regulation will be implemented gradually, with one diverse director required by August 2023 and the second by August 2025. Non-compliant companies may face delisting.

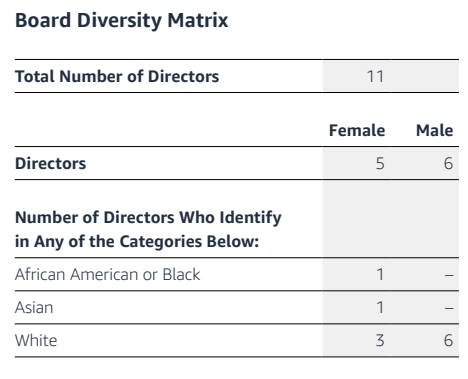

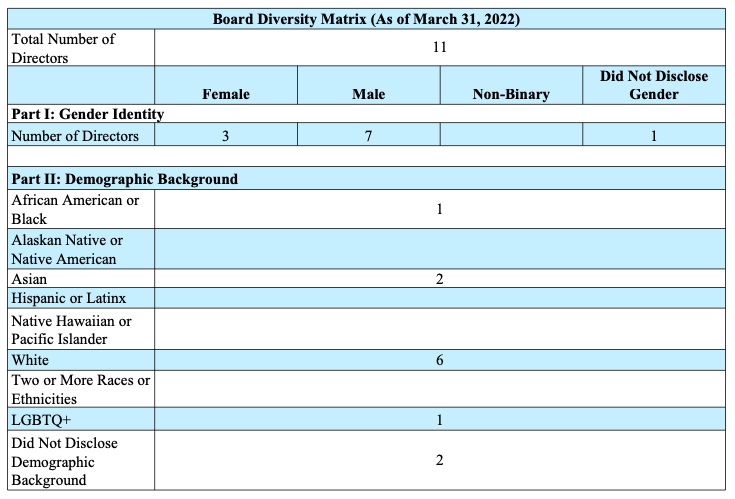

To determine if a director qualifies as diverse, NASDAQ has developed a Board Diversity Matrix. This matrix offers a straightforward format for quantifying the number of board members considered diverse. Many public companies now incorporate this matrix or a substantially similar format in their public disclosures and reports.

Recommended Board Reporting

In addition to the current and proposed requirements set by the SEC for governance body composition reporting, many industry leaders provide additional insights into the composition of their top-level management. Board composition: Greater than the sum of its parts highlights some of the best-practice disclosures that companies can consider when reporting on these matters. These include board independence, skills and qualifications, and diversity.

Board Independence

To ensure effective representation of investors and shareholders, publicly traded companies are mandated to have independent directors, also known as outside directors, serving on their boards.

For listing on the NYSE and NASDAQ, organizations must have a majority of independent directors on their boards. These stock exchanges recognize the importance of instilling investor confidence by ensuring that independent directors are free from any affiliations or relationships that could compromise their objectivity. Disclosing information about board member independence enhances transparency and fosters trust between the company and its shareholders.

To adhere to the NYSE rules, the Board conducts an annual assessment of the financial ties and charitable activities of directors and director nominees. The Board’s determinations regarding directors’ independence will be publicly disclosed in the company’s proxy statement.

Companies must evaluate and disclose the independence of each director on their board and provide a rationale for their decisions. If an entity does not issue an annual proxy statement, the Form 10-K annual report must include information explaining the board’s determination that the director’s relationship with the company is not material.

Skills and Qualifications

In addition to disclosing independence, the SEC also requires companies to provide background information about each board member. Typically, companies achieve this by providing a concise employment summary for each board member. Moreover, companies are obligated to summarize the skill set of each board member. This is often accomplished using a matrix format, as shown below.

Diversity

Board diversity is an essential aspect of board composition, encompassing both diversity of thought and action, as well as diversity of gender, ethnicity, and generation. Currently, the United States does not have a specific mandate regarding a minimum percentage of diverse board members. However, companies listed on the NASDAQ are required to have at least one diverse member, as stated in the NASDAQ exchange requirements mentioned earlier. Nevertheless, there are no existing regulations regarding reporting on diversity of thought and action, giving companies the opportunity to self-regulate in this area.

Some states have taken the initiative to establish their own mandates or disclosure requirements regarding board diversity. Presently, California is the only state that mandates gender diversity on boards. Companies headquartered in California are obligated to have at least one woman on their board or face potential fines. Additionally, at least 11 other states have implemented disclosure requirements pertaining to board diversity. Further information about these states can be accessed by clicking here.

Voluntary Reporting Guidance

It is worth noting that many companies also adopt non-authoritative standards to report their board composition. ESG frameworks established by organizations such as the Global Reporting Initiative, the Task Force on Climate-Related Financial Disclosures, and the Sustainability Accounting Standards Board, among others, have their own guidelines that companies adhering to these frameworks follow. These guidelines may encompass specific board composition disclosures similar to the ones mentioned above. Companies that align with these frameworks will adhere to these standards in addition to authoritative guidance.

Conclusion

SEC requirements implemented in 2009 and 2019, along with NASDAQ’s requirement introduced in 2021, have prompted the majority of public companies to commence reporting on their board diversity. Currently, most companies disclose board diversity in their sustainability reports and/or proxy statements. In their 10-K filings, companies typically refer to their proxy statements for board member information. However, if the SEC’s proposed rules on board diversity reporting are approved and NASDAQ and other exchanges persist in issuing their own board diversity regulations, companies will soon be obligated to disclose more detailed information regarding the diversity of their boards.