Identifying Sustainability-related Risks and Opportunities

Learn how to identify sustainability-related risks and opportunities in alignment with the IFRS S1 disclosure requirements.

The International Sustainability Standards Board (ISSB) recently released a set of International Financial Reporting Standards entitled “IFRS SI: IFRS Sustainability Disclosure Standard, General Requirements for Disclosure of Sustainability-related Financial Information.”

As stated in the very first pages, the objective of IFRS S1 is “to require an entity to disclose information about its sustainability-related risks and opportunities that is useful to primary users of general-purpose financial reports in making decisions relating to providing resources to the entity.” More specifically, entities are required to disclose information “that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium or long term.”1

IFRS S1 provides companies with more detailed requirements for sustainability disclosure. As global markets and stakeholders increase their focus on sustainability, companies are now required to disclose their related efforts. Specifically, companies are required to make disclosures about their “sustainability-related risks and opportunities” (SRROs). This raises the question: what exactly are SRROs?

Definition of SRROs

In order to appropriately report on sustainability-related risks and opportunities, companies must first understand what SRROs are. Unfortunately, the IFRS does not give a direct definition. The basis for conclusions of S1 states: “IFRS S1 specifies that SRROs arise out of the interactions between an entity and its stakeholders, society, the economy and the natural environment throughout the entity’s value chain. This description is intentionally broad.”2 While vague, IFRS S1 does provide guidance on factors leading to SRROs. As mentioned, SRROs stem from an entity’s interactions with stakeholders across its value chain. These interactions rely on various resources and relationships, including internal and external “natural, manufactured, intellectual, human, social or financial” resources.2

Based on these broad descriptions and factors, sustainability-related risks and opportunities can be defined as events or conditions arising from an entity’s relationships that may impact the entity’s ability to achieve its objectives, including financial performance. This definition will be assumed throughout this article.

How to Identify SRROs

After gaining a basic understanding of what an SRRO is, companies can begin to identify them. S1 requires companies to initially consider IFRS Sustainability Disclosure Standards when identifying SRROs. Companies are also required to consider the disclosure topics in the SASB standards. Then, if companies need additional guidance in identifying SRROs, they may consider the CDSB Framework Application Guides, recent publications of other standard-setting bodies, and SRROs identified by competitors in similar industries and geographical regions.1 Each of these sources is discussed below.

IFRS Sustainability Disclosure Standards

The first resource to help companies identify SRROs is the IFRS Sustainability Disclosure Standards. As of the publication of this article, the “only specific requirements the ISSB has issued for disclosing information about SRROs are in relation to climate-related risks and opportunities in IFRS S2.”2 The ISSB plans to release more disclosure requirements over time. For now, companies should use S1 for a broad overview of SRROs and S2 for climate-specific risks and opportunities. Other applicable SRROs can be identified using the additional sources discussed in this article.

While S1 lacks specific SRRO identification guidance, it does provide some examples of how companies should approach the process, specifically the step around analyzing a company’s interaction of resources within the value chain. The appendix illustrates how an entity dependent on water could be affected by the quality, availability, and affordability of water. This could interrupt operations and hurt financial performance. In this case, sourcing sufficient water would be an SRRO for this company. S1 gives an additional example of an entity that requires a highly specialized workforce. Because its business strategy depends on attracting and retaining qualified employees, this topic could be an important SRRO to the company. Specifically, the company could focus on the importance of recruitment, employment practices, employee satisfaction and engagement, and retention.1

The S1 basis for conclusions provides three more potential SRRO scenarios. The first is for a beverage company that could face water scarcity, potentially disrupting its operations. The second is for a clothing brand that may have the opportunity to switch to less resource-intense materials in its packaging, making the company more environmentally conscious. The third is for an electronics manufacturer that might face human rights risks within their supply chain, leading to potential reputational damage anddisruption.2 Each of these scenarios presents examples of relevant risks or opportunities to the entity.

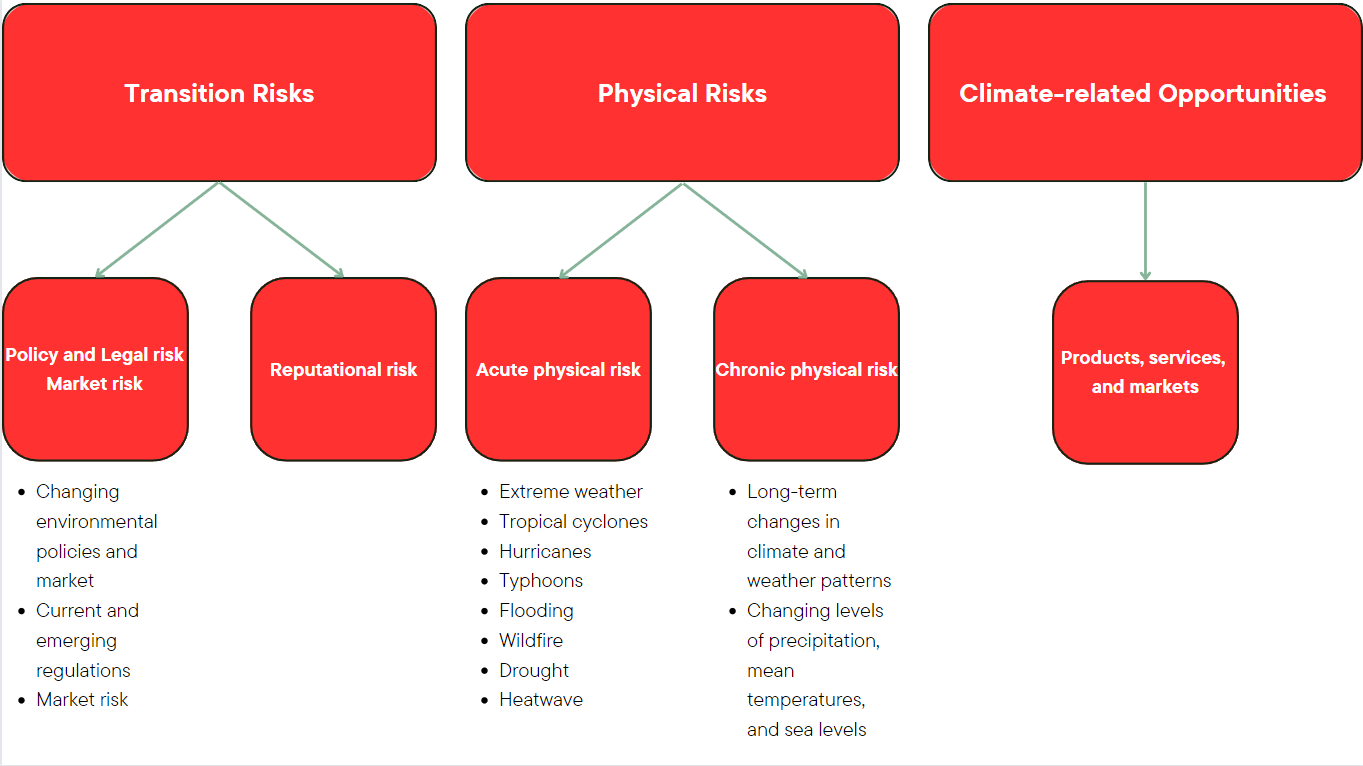

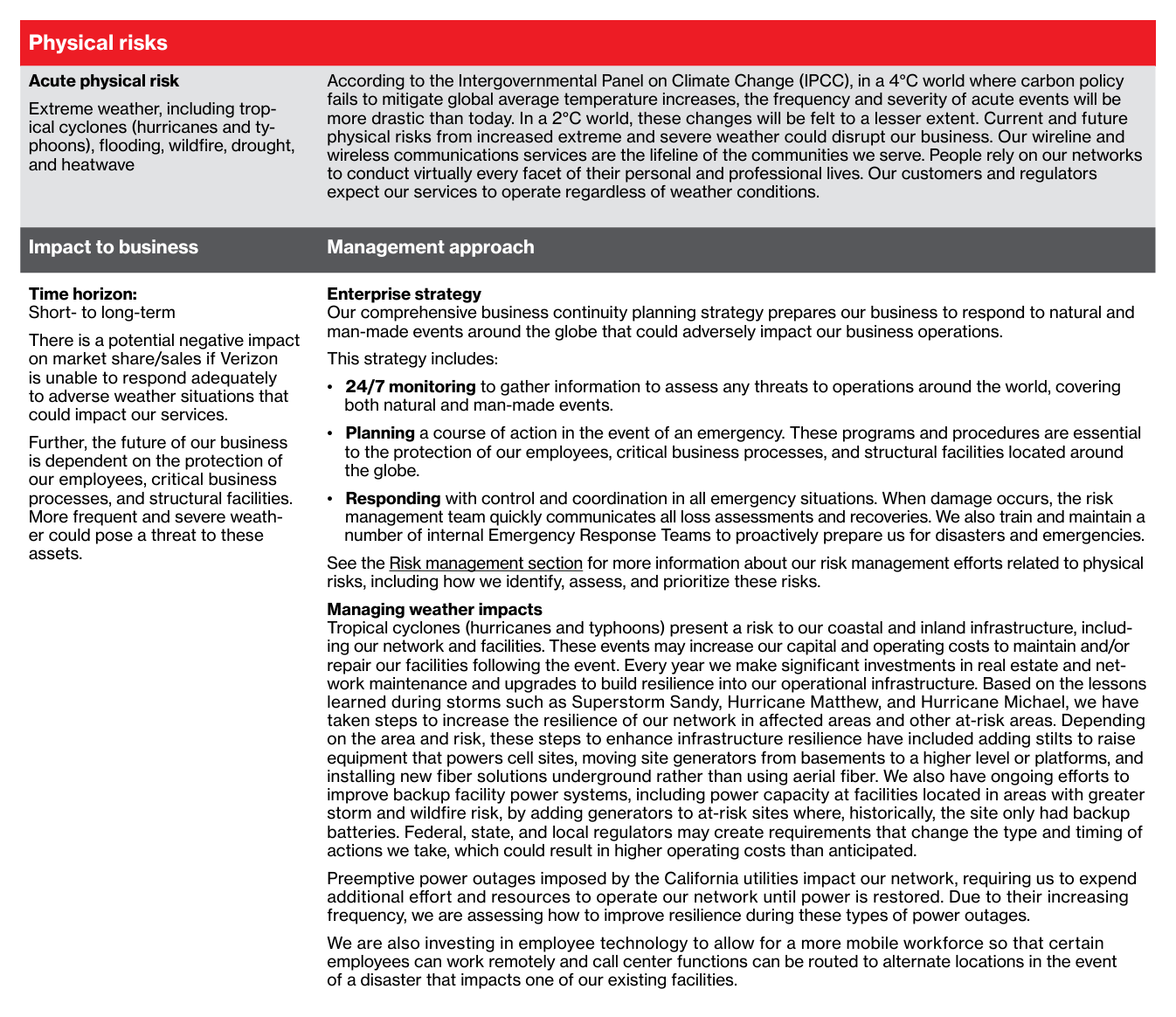

“IFRS S2: Climate-related disclosures” provides more specific climate-related risks and opportunities that should be considered. Some topics covered in S2 are greenhouse gas emissions, climate-related transition risks, climate-related physical risks, internal carbon prices, and renumeration.3 In addition, S2 has an accompanying document entitled “Industry-based Guidance on Implementing Climate-related Disclosures” that gives specific risks and opportunities for different industries. Although created as guidance for S2 implementation, this industry-specific material can also help companies recognize SRROs when applying S1. For a closer look at the content of IFRS S1 and S2, visit our article here.

SASB Disclosure Topics

After reviewing IFRS S1, S2, and the accompanying industry guidance, companies must also “consider the applicability of the disclosure topics in the SASB standards.”1 These standards were used to develop the IFRS S2 Industry-based guide, and therefore there may be overlap between the two standards. However, because considering the SASB standards is mandatory, companies should still consult the applicable industry SASB guide.

The Sustainability Accounting Standards Board (SASB) has released 77 industry-specific standards across 11 sectors: consumer goods, extractives & minerals processing, financials, food & beverage, health care, infrastructure, renewable resources & alternative energy, resource transformation, services, technology & communications, and transportation. Each standard identifies multiple disclosure topics for that industry. While some topics are unique to a particular industry, others are similar across many industries, like waste, water, energy, data security, greenhouse gas emissions, employee diversity and inclusion, labor practices, labor conditions, workforce health and safety, and business ethics. These common topics exemplify potential SRROs for companies.4 However, as mentioned in S1, “an entity might conclude that the disclosure topics…are not applicable in the entity’s circumstances.”1 Companies will need to use judgment to determine if a particular topic, and therefore SRRO, is relevant.

CDSB Framework Application Guidance

If an entity needs additional help in identifying SRROs, IFRS S1 states that it can consider the CDSB Framework Application Guides for water-related disclosures and biodiversity-relateddisclosures.1 Companies should refer to S2 and the SASB standards before consulting the CDSB application guide on climate-related disclosures.

Referencing the CDSB guides are not required by the IFRS but can serve as additional resources. For more information on the CDSB framework and application guides, please view our article here. (link forthcoming)

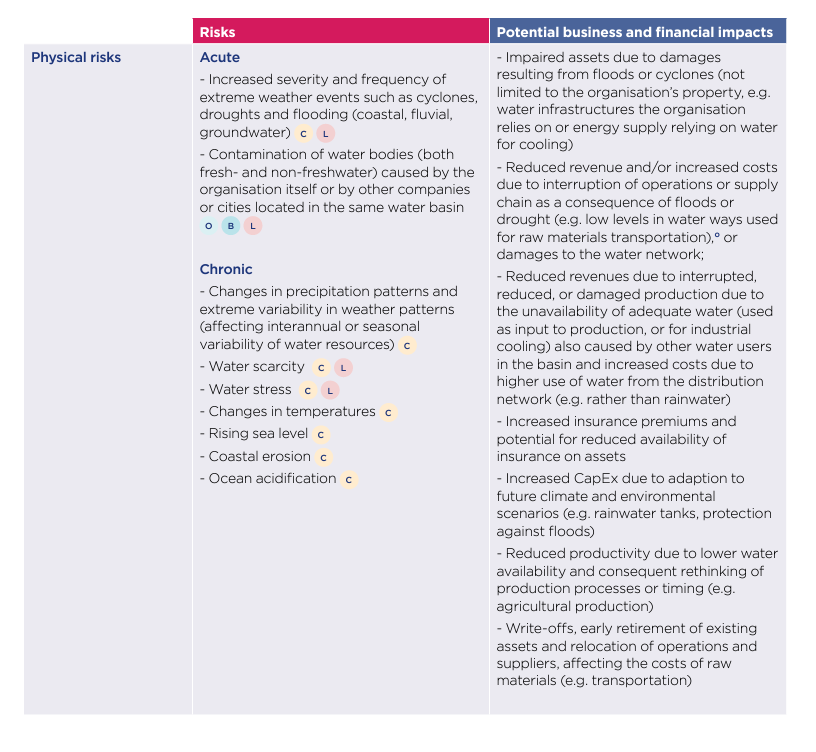

The CDSB application guides outline potential risks across physical, policy and legal, market, technology, and reputational dimensions. It also outlines potential opportunities, including resource efficiency, product and service and market, financial incentives, resilience, and reputation and relationship with stakeholders.5 The water and biodiversity guides display the risks and opportunities in very easy-to-read graphics (as shown below). For entities relying on natural resources, these standards could help identify relevant SRROs.

While many risks and opportunities differ across the guides, some are consistent across both areas. For example, similar risks include ocean acidification, changes to or tighter legislation surrounding nature rights, shifting customers' preferences to products that are low-impact, volatility in costs of raw materials, transition to cleaner technology, and lack of access to quality data. Similar opportunities include transition to more efficient services, increased reuse and recycle of natural resources, ability to diversify business activities, adopting landscape approaches and nature-based solutions, access to climate-related funds and bonds, collaborative engagement with stakeholders, and improved conditions ofecosystems.5 Such risks and opportunities represent potential SRROs for disclosure in an S1-compliant report.

Other

The last two sources of guidance outlined in IFRS S1 are (1) “the most recent pronouncements of other standard-setting bodies” and (2) “the SRROs identified by entities that operate in the same industry or geographical region.” This broad range of acceptable guidance helps“ facilitate transition to IFRS Sustainability Disclosure Standards by enabling entities to use sources that they might already be familiar with,”2 since many companies may already report aligned SRROs that can serve as peer benchmarks.

Recent pronouncements of other standard-setting bodies could include an SEC regulation (one is currently under proposal – see our article here), a state law (for example, California’s proposed requirements– see our article here), GRI Standards, or ESRS. The key point to remember here, however, is that these sources should only be used to the extent that the “information identified assists the entity in meeting the objective of IFRS S1 and that these sources do not conflict with IFRS Sustainability Disclosure Standards.”2 These outside standards may point companies to what kinds of risks and opportunities they should be aware of, but the standards should not be implemented and documented over the IFRS S1 requirements.

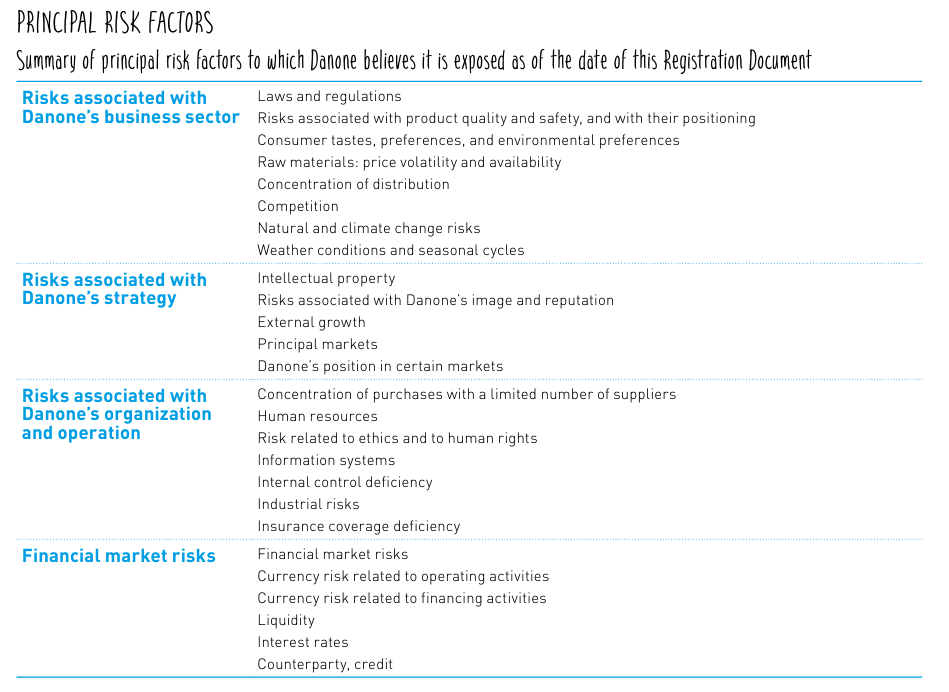

The final source of guidance given in S1 is the SRROs identified by other similar companies, whether they be similar through industry or location. Though a comprehensive analysis of peer SRRO reporting is beyond the scope of this article, two prominent companies provide examples of appropriate SRRO identification.

Conclusion

IFRS S1 is a requirement for companies creating meaningful sustainability reports. The first step in the reporting process is to identify an entity’s sustainability-related risks and opportunities. While the IFRS does not give exhaustive lists of what these SRROs could be, it provides companies with sources of guidance and direction in identifying them. These sources include the IFRS and SASB standards, which are required to be consulted, and the CDSB guides, other standards, and competitor examples. When taken together, these resources provide companies with sufficient information to identify the sustainability-related risks and opportunities that are most applicable to their situations.

References

1. IFRS S1

2. IFRS S1 Basis for Conclusions

3. IFRS S2

5. CDSB Website